- Home

- / Industries

- / Private Equity

Private Equity Consulting

How we can help

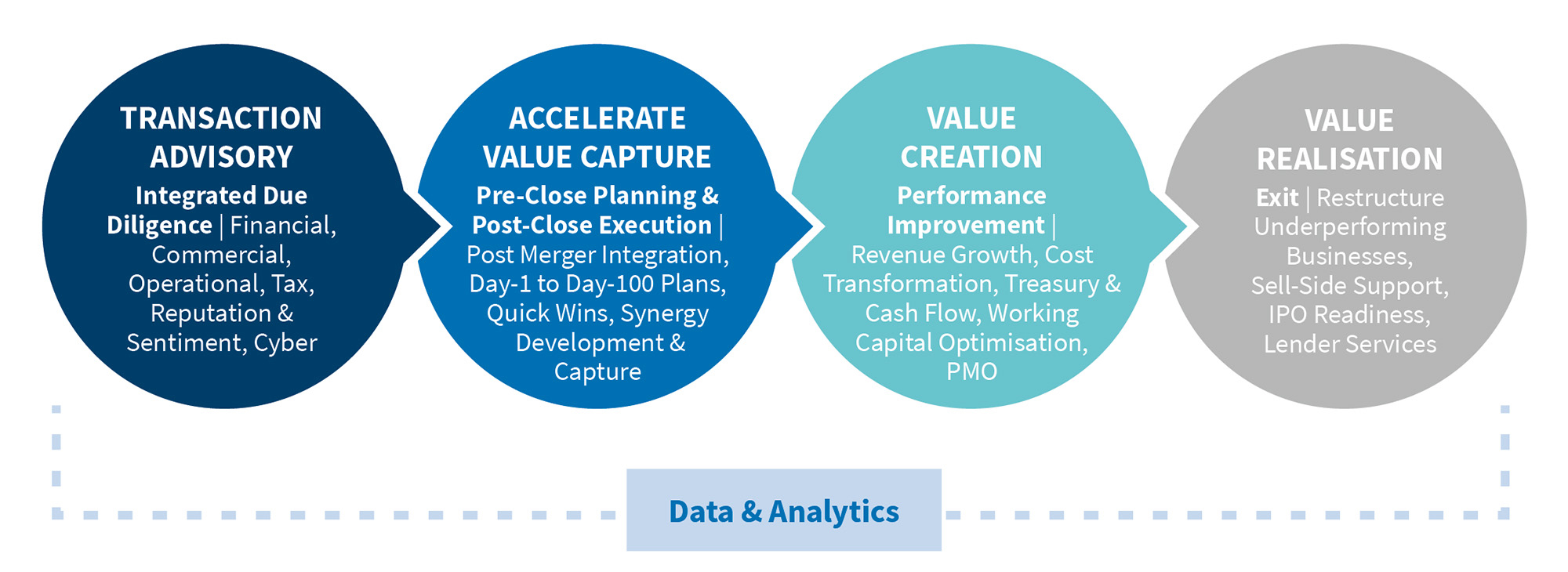

Our senior FTI Consulting experts work with the world’s leading private equity firms, credit funds and investment banks, providing pragmatic, transaction and execution-oriented services throughout the transaction lifecycle. From origination to exit, we use knowledge-driven skill and experience, focusing on critical financial, commercial and operational opportunities, to help create and enhance enterprise value.

Our practices, as standalone offerings and comprehensive solutions, address the many interconnected issues our clients face.

Solutions for Funds and Their Portfolio Companies

Free from audit-based conflicts and restrictions, we can provide a 360-degree lens across all facets of the business impacted by a transaction.

Our expert private equity consulting team drives transactions from pre- to post-close, supporting growth, transformation and event driven change for private equity clients.

FTI Consulting provides a unified cross-functional team to increase revenue, grow profitability, implement cost discipline, create liquidity and provide strong financial management.

Discover How FTI Consulting Delivers Global Solutions for Private Equity Success

How We Help

Transaction Advisory | Integrated Due Diligence

Comprehensive due diligence support to identify transaction-related risks and opportunities: Financial...

Comprehensive due diligence support to identify transaction-related risks and opportunities:

- Financial due diligence

- Commercial due diligence

- Operational due diligence

- Tax due diligence

- Reputational and sentiment due diligence

- Cyber due diligence

Accelerate Value Capture | Pre & Post Close

Leveraging data-driven insights and tried-and-tested playbooks to help rapidly identify and execute strategic...

Leveraging data-driven insights and tried-and-tested playbooks to help rapidly identify and execute strategic initiatives that maximise value:

- Post merger integration

- Data analytics and the Profit Cube

- Day 1 to day 100 plans

- Quick wins

- Synergy development and capture

Value Creation | Performance Improvement

Services and solutions across revenue growth, margin improvement and operational improvement: Revenue...

Services and solutions across revenue growth, margin improvement and operational improvement:

- Revenue growth

- Cost transformation

- Treasury and cash flow

- Working capital optimisation

- Project Management Office

Value Realisation | Exit

Industry and operational expertise to provide transaction and execution-oriented guidance: Restructure...

Industry and operational expertise to provide transaction and execution-oriented guidance:

- Restructure underperforming businesses

- Sell-side support

- IPO readiness

- Lender services

Cybersecurity & Data Privacy

Helping you understand cybersecurity and data privacy risks in a transaction: Address the compliance...

Helping you understand cybersecurity and data privacy risks in a transaction:

- Address the compliance landscape and applicability of cybersecurity and data protection laws

- Value missing or ineffective cybersecurity controls to support negotiations

- Review and assess adequacy of cybersecurity, privacy and data governance frameworks, policies and procedures

- Map data flows and identify critical IP and key risk areas

- Penetration tests to assess the effectiveness of cybersecurity controls

- Value information assets to support negotiations

- Assess key third-party arrangements and third-party risk

- Due diligence memoranda

- Post-acquisition integration and remediation work

- Compromise assessment to identify past or ongoing malicious activities

ESG & Sustainability

Proactive strategic ESG management around business risks and opportunities: Driving ESG strategy and...

Proactive strategic ESG management around business risks and opportunities:

- Driving ESG strategy and pre-IPO planning

- ESG and sustainability reporting

- Emissions measurement/climate risk assessment

- Risk management, due diligence and data analytics

Reputation & Sentiment Due Diligence

Intelligence and communication expertise needed to make informed investment decisions: Pre-transactional...

Intelligence and communication expertise needed to make informed investment decisions:

- Pre-transactional reputation and regulatory due diligence

- Sentiment risks for business including political risks, industry issues and stakeholder sensitivities

- Assessment of counterparty risk

- Actionable intelligence from on-the-ground sources

- Media support and communication strategy across the transaction life cycle

Meet Our Private Equity Experts

Mark Dewar

Senior Managing Director, Australia Leader

Sydney, NSW

Michael Bates

Senior Managing Director

Sydney, NSW

Keith McGregor

Senior Managing Director

Sydney, NSW

Ben Shrimpton

Senior Managing Director

Sydney, NSW

Wouter Veugelen

Senior Managing Director, Head of Australia Cybersecurity

Sydney, NSW

Dawna Wright

Senior Managing Director, Head of Australia Forensic & Litigation Consulting

Melbourne, VIC

Stuart Carson

Managing Director

Sydney, NSW

Tim de Sousa

Managing Director

Sydney, NSW

Carla Liedtke

Managing Director

Sydney, NSW