High Stakes, Higher Returns: Carve-Outs for Private Equity

-

January 21, 2025

-

As “higher for longer” interest rates weigh on more growth-oriented strategies, private equity (“PE”) sponsors are embracing carve-out acquisitions to generate value. At the same time, sellers are more motivated to narrow their focus on the core assets of their business and divest non-core assets. Under the right circumstances, corporate carve-outs provide an opportunity to right-size a cost structure, optimize operations, reinvigorate growth and incentivize the right management team to drive profitability. While strategic buyers may have the advantage of additional synergy capture by leveraging their existing platforms, PE buyers have a blank sheet to design a fit-for-purpose company to meet the specific requirements of customers and sub-sectors. While the upside is high for PE buyers, carve-outs also present a unique set of challenges and complexities that can hamstring performance and dilute returns if not proactively managed.

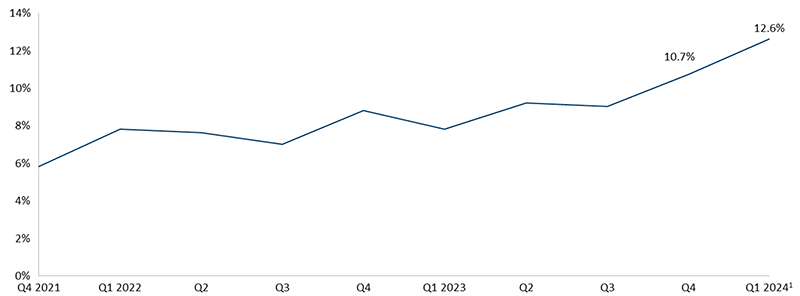

The opportunity is ripe for PE sponsors prepared to take on the challenge, with corporations continuing to be under internal and external pressure to divest non-core assets. Carve-out activity is cyclical; it peaked at 15.8% of all U.S. buyouts in 2013, then fell over the next eight years, sinking to 5.7% in Q421 — an all-time low, according to PitchBook. However, since reaching that low, carve-outs have bounced back, rising to 12.6% of all PE buyouts in early 2024.1

Carve-Outs/Divestitures as a Share of All PE Buyouts by Quarter

Source: PitchBook1 | Geography; United States as of March 31, 2024

Big number: 12.6%1

Carve-outs and divestitures represented 12.6% of all PE buyouts in the first quarter of 2024, up from an all-time low of 5.7% in the fourth quarter of 2021.1

Similarly, in Europe, corporate carve-outs expanded their share to 18.2% of deal value in Q324, the highest since 2019, and capital from non-European investors increased from last year according to PitchBook's Q324 European PE Breakdown.2

This opportunity notwithstanding, PE can sometimes struggle to operationalize complex, carve-out transactions. A series of financial, legal and operational pitfalls can arise during deal negotiations, from pre-sign diligence, sign-to-close planning and post-close execution. A transaction requires proactive navigation to ensure a smooth Day-1 and transition to standalone operations. To do that, it is important to consider the elements of a transaction that can fall between the cracks and the potential pitfalls to avoid throughout the carve-out life cycle.

Why Some Carve-Outs Fail

For PE or other financial buyers, four key drivers often determine the success — or failure — of a carve-out: 1) an extended sign-to-close timeline, 2) one-time cost overruns, 3) leadership inexperience and 4) a high degree of entanglement.

- Extended Sign-to-Close Timeline: Carving out a business unit or product line from the parent company and turning it into a standalone entity is time-intensive. Transition Service Agreements (“TSAs”), employee leasebacks and other transition mechanisms may be leveraged to shrink the timeline to closing and allow the new ownership to get the keys to the business earlier.

- One-time Cost Overruns: Delays in closing or gaps in standalone cost modeling can erode deal value, increase transaction costs and delay the overall value-creation timeline — especially if the upfront “one-time” investment required to stand up the company is underestimated. A clear and defined one-time cost budget for year one (or until TSA exit) can go a long way toward meeting financial objectives and mitigating short-term solutions that yield ‘tech debt’ down the road.

- Leadership Inexperience: Investment teams and management teams may have varying levels of experience navigating carve-out transactions. Experience operating a company is not the same as building a company; much like driving a car does not mean one knows how to build one. Augmenting the buyer and management teams with an experienced partner who can anticipate and address obstacles, go toe-to-toe with the seller and help ensure there are no operational gaps on Day-1 and post-TSA can help drive value creation or preservation.

- High Degree of Entanglement: IT and shared services are almost always highly complex and potentially problematic. Contracts with other third parties (vendors, customers, etc.) may often have codependencies between the separated entities (“CarveCo”) and the seller (“ParentCo”). Capability and bandwidth constraints for either buyers or sellers (or both) to design, plan and execute these key disentanglements can extend timelines and drive-up costs throughout the process.

Drivers of and Impacts to Unsuccessful Carve-Outs

Source: TMF Group3

Size Doesn’t (Necessarily) Matter

While carve-outs vary significantly in size and complexity, a common misconception is that the greatest complexity driver of a transaction is its purchase price — that a $5 billion deal is more complex than a $500 million deal. Focusing on the price of the deal (or topline of the CarveCo) involved overlooks some truly important elements that drive deal complexity, most of which are agnostic of deal size and centered on the deal structure and the CarveCo operating model. And while no two divestitures are identical, five variables can affect the overall complexity of a carve-out transaction:

- “Stock” vs. Asset Purchase: Is the transaction a stock purchase, an asset purchase or a hybrid? The deal structure may inform the required duration of the sign-to-close period. In a stock purchase, the company is likely to have key infrastructure in place to support Day-1 operations (legal entities, bank accounts, etc.) but may still have operational entanglement with the seller for services such as back-office IT, Finance and HR. In an asset purchase, key legal and operational steps may be needed prior to closing (such as legal entity formation, bank account opening, new employment agreements, contract assignment, etc.) to enable the CarveCo to operate as a new company and legal entity.

- Footprint: Cross-border international carve-outs are one of the most complex transactions an organization can undertake. Different jurisdictions have different legal and operating requirements that can affect the overall timeline of the transaction, including legal compliance, employee requirements and regulations, business registrations and licenses and payroll setup and processing.

- Entanglement: As noted above, the higher the level of entanglement between the seller and the carved-out entity, the higher the level of complexity and cost to separate and stand up. A TSA may also be needed to serve as a bridge to standalone operations. People, processes, technology, policies and third-party services — by functional area — will require in-depth assessments and Day-1 solutioning to ensure operations are ready across the TSA and standalone parts of the enterprise.

- Management Team: It is imperative that the current management team is equipped to effectively operate the business while standing it up, which involves challenges such as rapid decision-making and adopting new processes. While the team may not know every detail that is required, at a minimum, they must have a full appreciation for what it takes to operate the standalone business and know when to ask for help. Value created through financial engineering has declined by 50% since 2010,4 so it is more critical than ever to deliver on operational value creation. Overall, effective leadership plays a critical role in the ability to create value within a portfolio company. As noted above, driving a car is one skill, but building a vehicle requires a very different skill set. Management needs to have both or know when to leverage outside advisors and experts to support.

- Seller Readiness: Even if the buy-side team has carve-out expertise, complications may still arise if the seller has not previously divested a division or business unit to a financial buyer. And, given the internal and external resources these deals consume, PE deal teams face the added pressure of closing quickly. So, a seller with a proven track record in executing a divestiture can create or mitigate potential headwinds.

An Ounce of Prevention vs. a Pound of Cure

It is important for buyers to keep in mind the relationship between one-time costs and run-rate costs. Run rate is what it costs to run the carved-out business after the transition. If buyers execute successfully on the separation and stand-up, they will be able to optimize run-rate costs. But if they do not implement IT systems and operational processes correctly or try to get by using shortcuts, they will need more arms and legs in the organization to run the carved-out entity on a go-forward basis. Cost mitigation can be achieved with the right experts on the team to craft a scalable, cost-efficient, right-sized operating model for the CarveCo and a clear path to achieve it. This method may create higher one-time costs at the onset but will ultimately prevent an increase in run-rate costs. Appropriately anticipating, estimating and planning for these one-time costs in advance can help preserve value over the course of the hold period.

Conclusion

Despite a favorable climate and the potential for significant value creation, carving out a business unit or product line from its parent can be a complex and high-risk endeavor for PE buyers, requiring an investment of capital and time to create a standalone entity. Delays in closing the deal can deteriorate transaction value, increase one-time costs and delay the timeline for value creation. It is important to have a partner on the M&A journey who can anticipate and address obstacles, go toe-to-toe with the seller's deal team on pre- and post-close carve-out challenges and fast-track buyer return on investment.

IT, HR and Finance & Accounting present some of the most complex functional areas to separate. So, having a well-defined plan for each function is critical for Day-1 readiness and TSA exit. In the next installment of carve-outs for PE buyers, we consider these critical functional areas in more detail and how you can ensure their readiness.

Footnotes:

1: Kyle Walters, Tim Clarke, “PE Rediscovers Divestitures as a Value Creation Strategy,” PitchBook Data, Inc. (15 April 2024).

2: Nicolas Moura, “European PE Breakdown,” PitchBook Data, Inc. (14 October 2024).

3: TMF Group, “Cross-border carve-outs,” TMF Group (2020).

4: Institute for Private Capital, “Performance Analysis and Attribution with Alternative Investments,” Institute for Private Capital (12 February 2022).

Published

January 21, 2025

Key Contacts

Key Contacts

Senior Managing Director

Managing Director

Managing Director

Senior Managing Director