Changing Gears: Navigating Divestitures in the Electric Vehicle Sector

-

December 09, 2024

DownloadsDownload Article

-

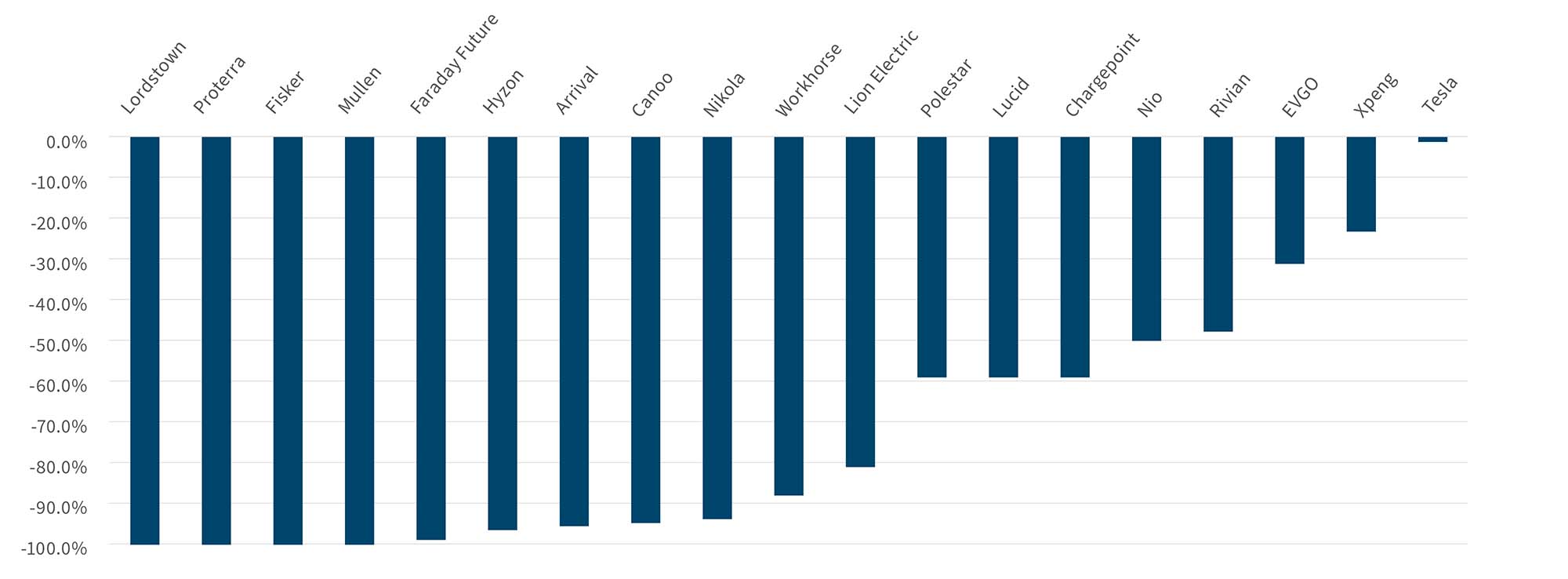

Ambitious federal and state goals for electric vehicle (“EV”) deployment and commercialization, bolstered by government programs and funding, have drawn considerable private investment in the EV value chain.1 Billions were raised in the space at the start of this decade, with some companies trading up to multiple billion-dollar valuations. Recently, however, EV companies have lost favor in the markets. The companies have struggled to maintain momentum, having encountered significant obstacles in the capital-intensive nature of EV manufacturing, supply chain and procurement challenges, and lower-than-expected demand for vehicles.2 Start-up EV makers — many of which went public in 2020-2021 via special-purpose acquisition vehicles (“SPACs”) — are now contending with significant declines in share prices as they rapidly burn through cash and attempt to raise funds to extend their liquidity runway. Some EV companies, including Lordstown, Proterra, Fisker and Arrival, have even been forced to file for bankruptcy.3

Losing Speed: Share Price Change from 52-Week High

Chart: FTI Analysis, stock price as of 12/04/2024.

Given these industry challenges, some EV companies have opted to divest non-core assets or subsidiaries to improve liquidity. One example is Proterra, which sold its battery manufacturing unit to the Volvo Group in early 2024. While a divestiture can be an obvious choice for many liquidity-hungry EV companies, such a strategy comes with certain potential pitfalls. What can EV companies do to maximize the value of a potential divestiture? In our experience, companies considering a divestiture should focus on simplifying their organizational structures, identifying and resolving key entanglements within the organization and divested entity, retaining key talent before and during the transition, and clearly defining a deal perimeter before identifying a buyer.4

We have seen the pressure to resolve supply chain challenges and financing issues quickly lead many EV companies to scale business segments rapidly without a strategic focus. This has been exacerbated in the EV space by the myriad supply chain challenges that have led certain upstart electric automakers toward becoming OEMs, attempting to in-house complex components without the capabilities or scale to do so economically. The result is a complex web of systems that can make carving out business units complicated and require costly work-arounds. These are issues that create difficult challenges during and immediately after a divestiture. Our advice to those looking to follow this path — as with energy transition businesses more broadly — is to identify and deal with these challenges well ahead of a transaction.

Key Considerations

Look for and resolve entanglements. Ahead of a carve-out or divestiture, management should focus on identifying areas of entanglement between the core business and the entity identified for divestment. A plan must be put in place to preemptively begin separating the supporting systems of the organization; commonly overlooked areas are IT systems and supply chain. Companies should consider structuring their organizations to support a seamless transition, thereby maximizing the transaction value and minimizing the costs and complexities associated with disentanglement.

Understand the impact on EV synergies. Each EV manufacturer requires unique skills, facilities, equipment, personnel and expertise, making it challenging for EV companies to recognize cost synergies. Scaling manufacturing of several new technologies to commercialization at once increases the risk of quality control issues, cost overages, and challenges managing personnel and inventory, which can in turn increase liquidity problems rather than drive cost savings. Prior to scaling business operations or acquiring a player in the value chain, potential acquirers must perform adequate due diligence on their ability to achieve synergies.

Two additional focus areas to drive success in EV divestitures are employee retention and executing operational separation to maximize deal value:

Retain essential employees. The EV industry requires a highly skilled and technical workforce, making employees one of the greatest assets for an EV company. The loss of key employees prior to or during a transition can severely impact overall transaction value and even force an asset liquidation. Sellers should determine which employees will be required to support the transition, offer retention packages as needed, and collaborate with the buyer to ensure a smooth transition and onboarding experience for all employees.

Make maintaining business continuity a priority. The separated entity or asset needs to be able to maintain business continuity as a stand-alone entity, and the key to this is execution of operational separation. Inability to maintain business continuity could reduce revenue and EBITDA for the buyer. This situation poses challenges for EV companies looking to effectively manage liquidity and costs and preserve operations. Day 1 operating considerations include preparing third-party solution providers, including financial institutions, payroll providers and inventory providers, for the transaction timeline. Inventory is an essential piece of the transition in the EV industry, and keeping the production line moving requires the availability of sufficient components on Day 1 as well as access to inventory that can be readily replenished by the acquirer. To align incentives in these areas, it is common for the transaction parties to negotiate a premium paid to the seller to assist in the separation of the business to be divested, based on the seller’s expertise, legacy knowledge and experience with the product and its complexities.

Conclusion

When seeking to successfully set up a carve-out or divestiture transaction in the EV sector, it is critical to identify and resolve entanglements between the core business and the entity being divested and to perform adequate due diligence to provide comfort that expected synergies can be realized. In addition, keeping key employees in place and providing the needed incentives to do so and ensuring a successful transaction and its aftermath. Engaging early and prioritizing these key considerations during a carve-out or divestiture will support a successful outcome, while a lack of planning or mismanagement of any of these elements can harm value. A trusted and experienced advisor can assist transaction parties to navigate these complex processes in order to enhance the likelihood of success and maximize value.

How We Can Help

FTI Consulting’s Power, Renewables & Energy Transition professionals have functional expertise across the life cycle of renewable energy participants. Our seasoned team provides tailored services for strategic and financial investors, creditors and corporates, and has deep experience with renewable energy platforms, projects and portfolios. FTI Consulting team members have developed and applied best practices in strategic market entry, transaction advisory, due diligence and operational transformation. We assist leading strategic and financial investors across all stages of the transaction life cycle, including strategy, diligence and the pre-sign, sign-to-close and post-close phases of merger integration and carve-out transactions. Our team customizes the scope of our engagement models to provide solutions tailored to our clients’ needs, from full-scale transaction execution to specific Project Management Office (“PMO”) or functional subject matter expertise, always working in partnership with leadership and key stakeholders. FTI Consulting’s Power, Renewables & Energy Transition professionals have functional expertise across the life cycle of renewable energy participants, including deep experience in the e-mobility space.

Footnotes:

1: The White House, “FACT SHEET: Biden-Harris Administration Announces New Standards and Major Progress for a Made-in-America National Network of Electric Vehicle Chargers”, The White House (February 15, 2023).

2: Korosec and Wilhem, “The EV SPACs are running out of juice”, Tech Crunch (September 18, 2023).

3: Jing, Yeh, et al., “2023 Battery Report”, Volta Foundation (January, 2024).

4: Gleichenhaus, Smith et al., “Business Continuity: Three Nuanced Focus Areas for Divestitures”, FTI Consulting (September 1, 2023).

Related Insights

Published

December 09, 2024

Key Contacts

Key Contacts

Global Practice Leader Power, Renewables & Energy Transition (PRET)

Managing Director

Senior Director

Senior Consultant